We all have a list in our heads.

Family. Faith. Freedom. Health. Peace. Security. Growth. Legacy.

If I asked you what matters most to you, you wouldn’t hesitate. You’d answer with confidence from the heart. And I would believe you.

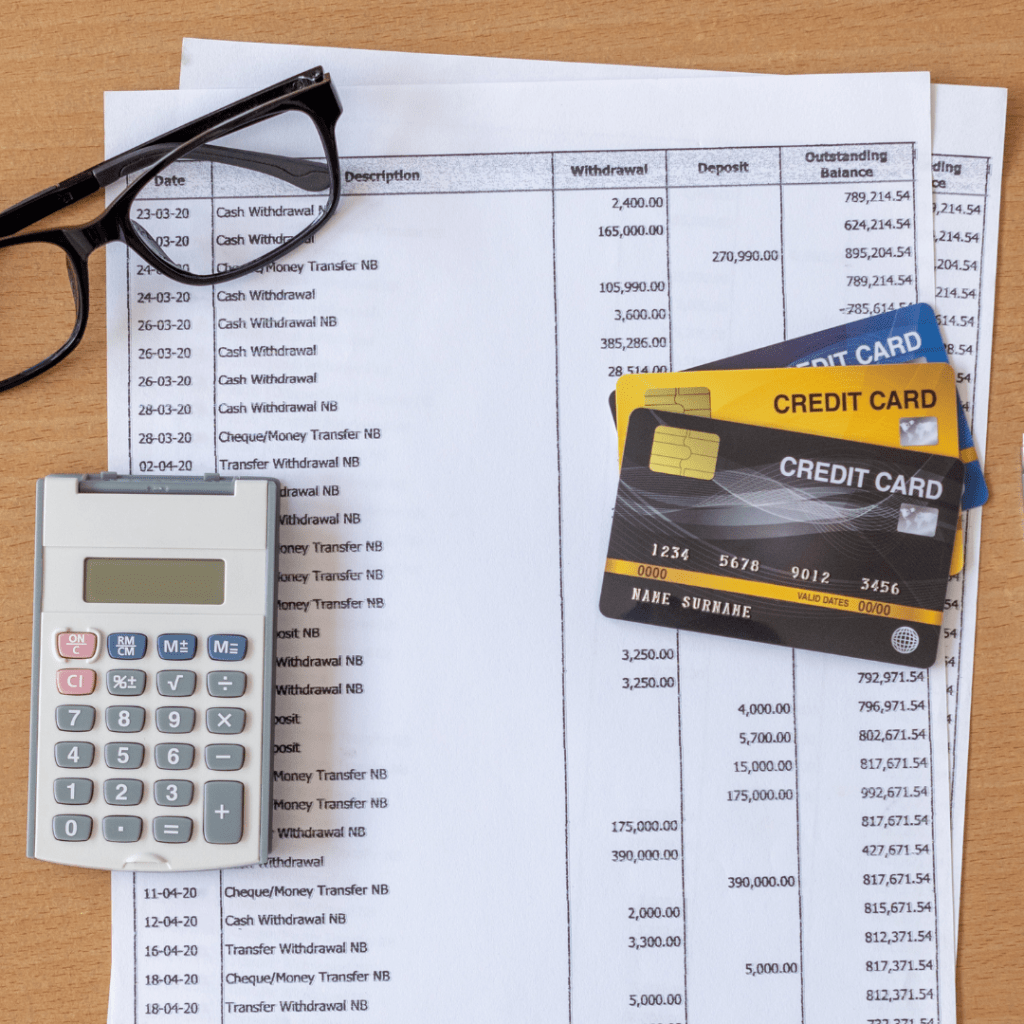

But if you slid your bank statement across the table…

I’d learn something else too.

Not because you’re lying.

But because money keeps a record of what we actually choose.

Your bank account isn’t trying to teach you a lesson.

It simply tells the truth.

And sometimes, that truth is uncomfortable.

The Gap Between Values and Behavior

Most people don’t struggle with values.

They struggle with alignment.

We say we value:

- Financial peace, but live paycheck to paycheck..

- Family time, but buy convenience instead.

- Freedom, yet finance everything.

- Health, but ignore our own care.

- Growth, but we rarely invest in learning or getting help.

Again, this isn’t about shame.

It’s about awareness.

Because money follows behavior.

And behavior follows habits.

And habits often operate without permission from our values.

Your bank account is a mirror.

It reflects what felt urgent.

What felt comforting.

What felt necessary in the moment.

And what felt easier than sitting with discomfort.

Spending Is Emotional, Not Logical

We like to pretend we are rational with money.

We are not.

We spend when we are tired.

We spend when we are bored.

We spend when we are stressed.

We spend when we are trying to feel something.

Sometimes we spend to celebrate.

Sometimes we spend to numb.

Sometimes we spend to belong.

Sometimes we spend to escape.

Your bank statement doesn’t just show transactions.

It shows emotional patterns.

It shows where you run for relief.

It shows what makes you feel safe.

It shows what you use to cope.

And once you see that, you can’t unsee it.

The Story Money Is Telling About You

Imagine your bank account could talk.

It might say:

“I value convenience more than rest.”

“I value comfort more than margin.”

“I value appearances more than peace.”

“I value quick relief more than long-term stability.”

“I value survival over strategy.”

Or it might say:

“I value preparation.”

“I value choice.”

“I value future me.”

“I value flexibility.”

“I value alignment.”

Neither story makes you a good or bad person.

But one story gives you options.

The other quietly removes them.

Priorities Aren’t What You Claim — They’re What You Fund

If something truly matters to you, it shows up in one of three places:

- Your calendar

- Your energy

- Your money

When all three agree, life feels grounded.

When they don’t, life feels heavy.

You can say you want financial freedom, but if every dollar is assigned to comfort, distraction, and reaction, freedom stays theoretical.

You can say you want peace, but if your spending creates pressure, peace stays distant.

You can say you want growth, but if nothing is invested in learning, growth becomes wishful thinking.

This isn’t about cutting joy.

It’s about deciding what kind of joy you want later.

Why This Feels Personal

Money touches everything:

- How you sleep

- How you argue

- How you dream

- How you choose

- How you feel about yourself

That’s why conversations about money often feel like conversations about worth, security, control, and identity.

You aren’t just managing numbers.

You are managing your relationship with safety.

So when I say, “Show me your bank account,” what I’m really saying is:

Show me what you protect.

Show me what you fear.

Show me what you trust.

Show me what you avoid.

Show me what you believe about yourself.

The Quiet Power of Alignment

Alignment doesn’t require perfection.

It requires honesty.

Alignment is when your money begins to reflect who you are becoming, not just who you have been.

It’s when you pause before spending and ask,

“Does this support the life I say I want?”

It’s when you stop treating future-you like a stranger.

It’s when your values stop living only in words and start living in the numbers.

Alignment is peaceful.

Even when the numbers are small.

Even when progress is slow.

Because direction matters more than speed.

The Hardest Truth

If your bank account doesn’t match your values, it doesn’t mean you lack discipline.

It often means you lack clarity.

Most people were never taught how to connect values to spending.

They were taught how to earn.

They were taught how to swipe.

They were taught how to survive.

They were rarely taught how to choose.

You Don’t Need a New Budget. You Need a New Conversation.

Not a spreadsheet conversation.

A values conversation.

A “what kind of life do I actually want to fund” conversation.

A “what am I willing to delay for something better” conversation.

A “what am I tired of pretending doesn’t matter” conversation.

Because once your values are clear, the numbers become easier.

Not easy.

But clearer.

A Gentle Challenge

Pull up your last 30 days of spending.

Don’t judge it.

Don’t explain it.

Don’t justify it.

Just observe it.

Then ask:

What does this say I care about?

What does this say I avoid?

What does this say I protect?

What does this say I prioritize?

You may discover that your money isn’t betraying you.

It’s just telling you where you’ve been living on autopilot.

And autopilot can be changed.

This Is Where Real Financial Peace Starts

Not with restriction.

Not with guilt.

Not with comparison.

But with awareness.

When you see your money clearly, you gain choice.

And choice is where peace begins.

Final Thought

Your bank account is not your enemy.

It is your most honest feedback partner.

It shows you where your life is currently funded.

And it quietly invites you to decide if that still fits who you are becoming.

Reflection Question:

If your bank account had to explain your priorities to someone who’s never met you, would you feel proud of the story it tells or want to rewrite it?

If you’re ready to rewrite it, start with one small, honest shift. One choice that supports the life you actually want to live. And let that be enough for today.

If you’d like help making your money match the life you actually want, I’d love to support you. You can schedule a conversation with me when you’re ready.

You can even do a one time jump start session to get you going in the right direction dhttps://meetings.tulincu.com/public/693db1c6538dba003187eb5d