Last week we talked about how money isn’t just math, it’s emotional.

This week, we go a layer deeper.

Those emotions around money?

Most of them were formed before you ever had a bank account, a job, or a credit score.

Your money habits are older than your financial knowledge.

And they were shaped when you were little and just trying to make sense of the world.

You Learned About Money Before You Learned Multiplication

Nobody sat you down at age seven and said,

“Today we will form your lifelong beliefs about spending, saving, and self-worth.”

And yet… that’s exactly what happened.

You learned by watching how adults talked about bills. Whether money conversations sounded calm or tense. If asking for things felt safe or shameful. Whether money meant freedom… or fear.

Kids are meaning-making machines.

You didn’t just see what was happening — you decided what it meant.

And those beliefs didn’t stay in childhood.

They quietly followed you into adulthood and now they’re hanging out in your checking account.

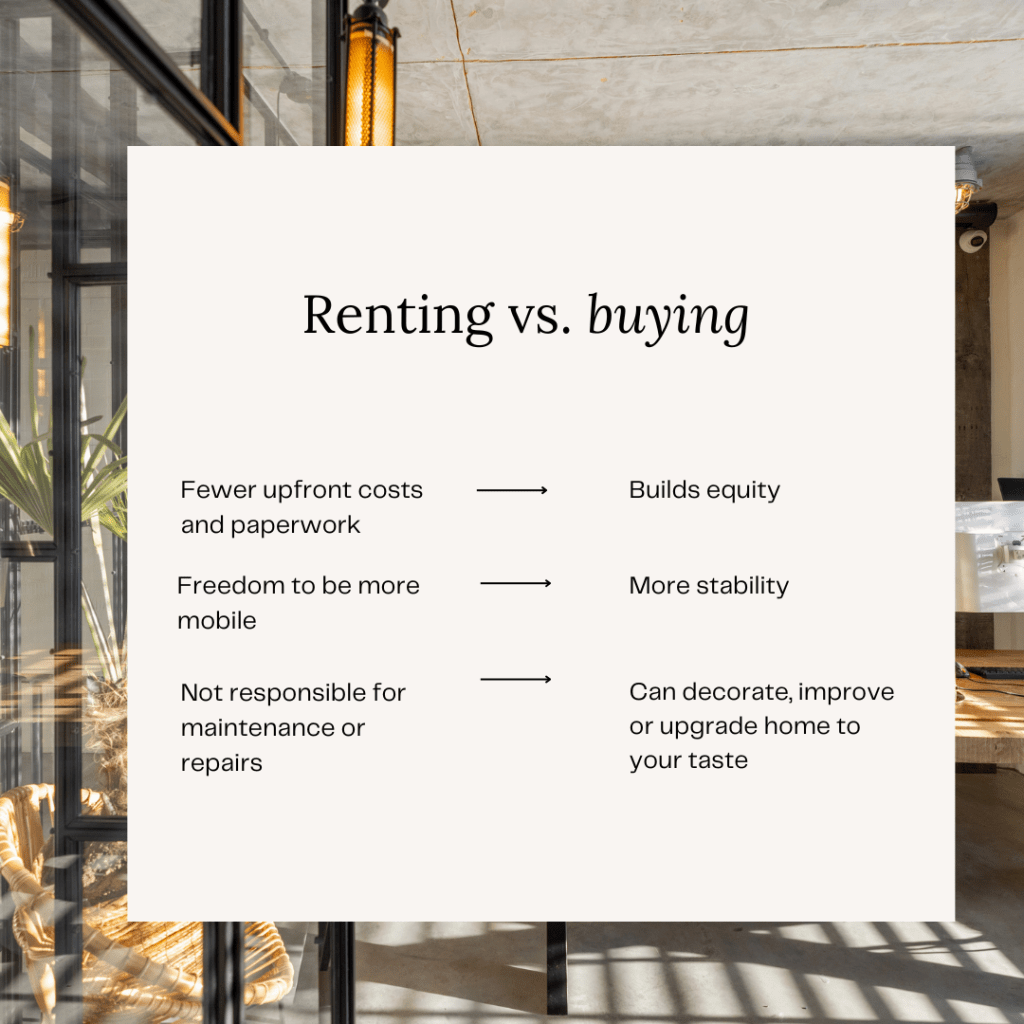

Some of Your “Money Problems” Are Old Survival Skills

Here’s where it gets interesting.

A lot of the habits you’re frustrated with today started as ways to feel safe, loved, or in control when you were younger.

Overspending might be: “Buying things makes me feel better when life feels shaky.”

Under-earning might have roots in: “If I don’t outshine people, I won’t make anyone uncomfortable.”

Avoiding bills could trace back to: “Money talk leads to conflict, so it’s safer to ignore it.”

None of those started because you’re irresponsible. They came from emotional learning.

Your nervous system learned what money felt like long before you understood how money worked.

“I’m Bad With Money” Is Usually a Story, Not a Fact

One of the most damaging money beliefs people carry is this:

“I’m just bad with money.”

That belief rarely starts with an adult financial mistake.

It usually starts with a moment when you felt small, embarrassed, or powerless around money.

Maybe you grew up hearing “we can’t afford that” said with stress or anger and you felt guilty for needing something. Maybe you watched someone else control all the money. Or you saw money cause arguments, silence, or distance.

So your brain built a story:

“Money is stressful.”

“Money causes problems.”

“I shouldn’t want too much.”

“I don’t know how to handle money.”

And that story can run your financial life for decades, quietly influencing choices you think are purely logical.

Adult You Is Trying to Budget…

While Inner Kid You Is Trying to Feel Safe.

This is why knowing what to do doesn’t always mean you’ll do it.

You can understand that you should spend less, save more, pay down debt, stick to a plan, and still feel resistance you can’t explain.

Because part of you isn’t making decisions from a calculator.

It’s making decisions from old emotional programming.

When your bank balance drops, you may not just see a number.

You might feel the same fear you felt hearing adults whisper about money in the kitchen.

When you treat yourself to something nice, you may not just feel enjoyment.

You might also feel guilt that traces back to being told “that’s too expensive”.

The situation is current, but the emotional reaction might be decades old.

Tiny Bit of Truth That Might Sting (In a Good Way)

Some people don’t have a spending problem.

They have a comfort problem.

Or a self-worth problem.

Or a fear-of-conflict problem.

Money just ends up being the place where all that shows up.

You’re not just managing dollars. You’re navigating emotions that formed long before you had adult responsibilities.

And here’s the beautiful part — God isn’t surprised by any of this.

He sees the whole story. The little-kid moments. The adult struggles. The parts you feel embarrassed about.

There’s grace in this process. You’re learning, not failing.

How to Start Rewriting Your Money Story

You don’t need to dig up every childhood memory. This isn’t a therapy session on your couch with dramatic music playing.

But a little awareness goes a long way.

Try this:

Ask: “What did money feel like growing up?”

Was it tense? Scarce? Secretive? Generous? Chaotic? Calm?

Notice your emotional reactions now

When do you feel the most stress around money?

Spending? Checking your balance? Talking about finances?

That reaction may be connected to an old emotional imprint.

Separate past from present

You’re not that kid anymore.

You have more choices, more knowledge, and more power than you did back then.

You can invite God into this area too, not just for provision, but for healing the fear, shame, or pressure attached to money.

Your financial life today doesn’t have to follow emotional rules written years ago.

This Is Where Change Gets Real

Last week, we said money is emotional.

This week, we name where many of those emotions were born.

Not to blame the past. Not to stay stuck in it. But to understand yourself with more compassion and less shame. Because when you realize, “Oh… this isn’t just about money,” you finally get space to respond differently.

And that’s where new habits and a new financial story begin.

If this stirred something up for you, that’s a good sign. Awareness is the first step toward change that actually sticks. So sit with it a bit. Pray about it. Journal on it. Pay attention to your reactions this week. When you understand the emotional roots, the habits finally start to make sense, and that changes how you move forward.