What if the “dream” you’ve been chasing is the very thing making you tired?

Not physically tired. Soul tired.

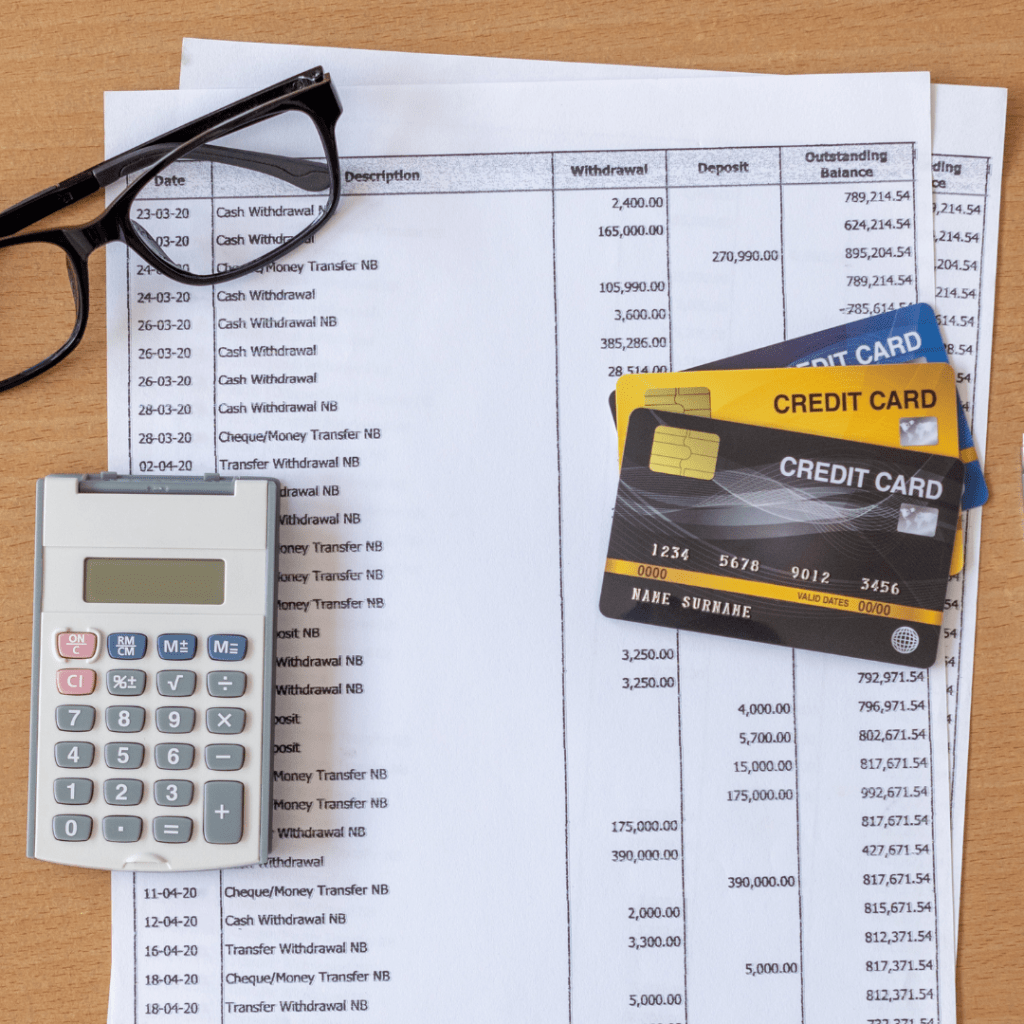

The kind of tired where your calendar is full, your car payment is impressive, and your bank account still makes you a little excited when you open the app.

We were handed a script somewhere along the way. Work hard. Earn more. Upgrade often. Bigger house. Nicer car. Better vacations. Rinse and repeat. And if your neighbor adds a patio, apparently that means you need one too.

Keeping up with the Joneses has turned into an Olympic sport, and most of us are competing in events we didn’t realize we signed up for.

Here’s the honest question. Is it actually making you happy?

I’ve sat with enough people in financial transition to tell you this. The stress rarely comes from not having enough stuff. It comes from having too many obligations. Too many payments. Too many things that looked good on the outside but little by little stole peace on the inside.

Some of you don’t need a raise. You need relief.

Living more simply doesn’t mean selling everything and moving into a tiny cabin in the woods (unless you really want to). It means asking a braver question. What do I actually value?

Do you value margin in your bank account or matching patio furniture? Do you value unhurried dinners at home or the image of being “busy and important”? Do you value freedom or financing?

Jesus talked a lot about this, which I find interesting. In Matthew 6:21 He says, “For where your treasure is, there your heart will be also.” Not where your intentions are. Not where your Pinterest board is. Where your treasure is.

If your treasure is tied up in appearances, your heart is going to feel stretched thin trying to maintain them and empty trying to convince yourself they have purpose.

I’ve watched clients breathe differently when they decide to simplify. When they downsize the house that felt impressive to friends but heavy to own. When they trade the luxury SUV for something reliable and easier to pay off. When they stop saying yes to every trip, every event, every upgrade, just to prove they can.

At first, it feels like you’re “losing.” Your pride might whine a little. You might worry about what people will think.

Then something surprising happens.

You sleep better.

You check your bank account without that spike of adrenaline.

You start making decisions from intention instead of insecurity.

Living more simply financially can look like fewer monthly payments. A smaller mortgage. A car you actually own. A budget that reflects your real priorities instead of your social media feed. It can look like choosing experiences that matter over optics that impress.

It can also look like finally admitting that the dream you were chasing wasn’t even yours.

Sometimes the “dream life” is just a well-marketed version of someone else’s vision.

Peace, though? That’s personal.

I think about the years in my own life where I was rebuilding. Working multiple jobs. Counting every dollar. I didn’t have the dream house (not even A house) or the polished image. What I did have was clarity. I knew what mattered. My kids. Stability. Faith. A future that didn’t feel like it was balancing on a credit card statement.

Strangely, those were some of the most grounded years of my life. It’s funny how now that I “have it all” I yearn for parts of those days and am actively working to simplify my life again.

There’s a verse in 1 Timothy 6:6 that says, “Godliness with contentment is great gain.” Not Godliness with a side of granite countertops. Just contentment.

Contentment isn’t complacency. It’s confidence. It’s knowing you don’t need to perform financially for anyone else. It’s trusting that provision doesn’t have to come wrapped in comparison. I’m not saying you should give up your job and live like a pauper. What I’m saying is maybe it’s time to reevaluate your lifestyle and what you’ve made important.

If you finally got what you wanted and it still feels like something is missing it could be that you built around expectations instead of convictions.

Living more simply could mean fewer things and more margin. Fewer payments and more generosity. Fewer comparison spirals and more gratitude. It could mean your money finally supporting your life instead of your life constantly trying to support your money.

And that changes everything.

Maybe the goal isn’t to impress the Joneses.

Maybe the goal is to sit at your own table, in your own home, with people you love, and feeling peaceful.

That sounds like a dream worth chasing.