Somewhere along the line, we were told that buying a home is the big “American Dream.” You know, fresh-cut grass, neighbors waving from the driveway, and a dog that finally has a yard to dig in. But as a financial educator and someone who spent years in real estate and mortgage, I want to slow us down for a second and ask: Is this dream really your dream right now or is it someone else’s?

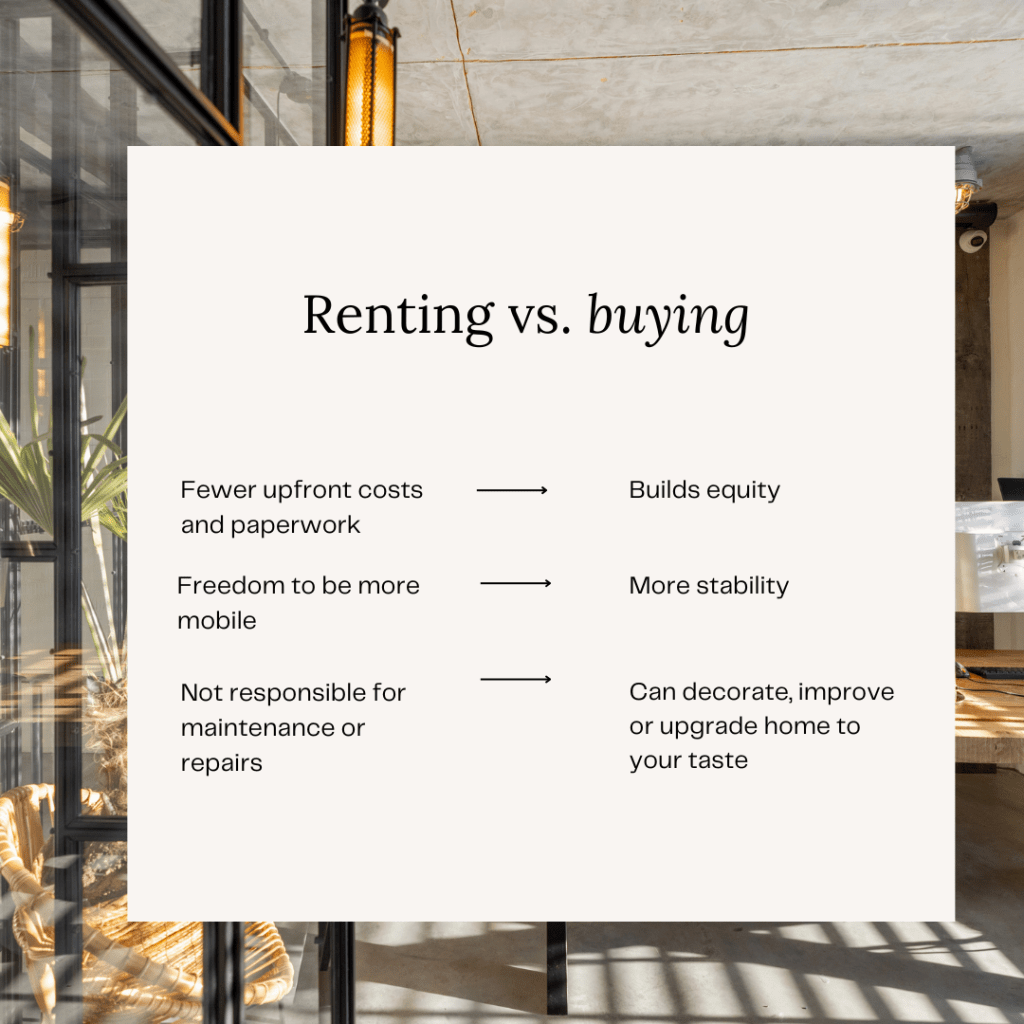

Homeownership can be a beautiful blessing. It can give you stability, equity, a sense of accomplishment, and a place to build memories. But before you start shopping for throw pillows and paint colors, let’s talk about what it really takes to be ready.

More Than a Mortgage

Buying a home is not just about affording the monthly payment. It’s about understanding the whole picture. Property taxes, insurance, maintenance, HOA fees, and yes, that water heater that always seems to break at the worst possible time.

It’s like Luke 14:28 reminds us: “For which of you, intending to build a tower, does not sit down first and count the cost?” God isn’t trying to scare us with that scripture, He’s reminding us that wisdom is in preparation.

Questions to Ask Yourself Before Buying

Instead of asking, “Can I buy a house?” try asking:

- Do I have a healthy emergency fund for the unexpected?

- Is my income steady enough to handle both the expected and the surprises?

- Will buying this home bring peace to my life or pressure?

- Am I looking at this house as an investment in my future, or as a way to prove something to others?

Sometimes the most powerful prayer you can pray in this process is, “Lord, is this right for me?”

The Beauty of Renting

Here’s where I like to shift the narrative: renting isn’t a “failure.” Renting gives you flexibility, space to change paths without being tied to a mortgage. It allows you to focus on building your foundation, whether that’s paying off debt, growing savings, or preparing for the home that will truly fit your life later on.

My Personal Take

There have been seasons when buying a home was the right move for me, and seasons when renting gave me the freedom I needed. The truth is, neither one makes you more “grown up” or more successful. What matters is whether your choice lines up with your values and with God’s plan for your life.

A Final Word

Whether you buy or rent, your worth isn’t tied to your mortgage statement. Proverbs 24:3 says, “By wisdom a house is built, and by understanding it is established.” The wisdom comes first—the house comes second.

So if you’re thinking about buying, pray about it, run the numbers, count the costs, and make sure it fits not just your budget, but your calling. And when the time is right, you’ll step into it with peace, not pressure.

And if you do end up with that yard, may God bless you with the kind of joy that makes it more than just a piece of land, it becomes a piece of your story.